STOCKS, BONDS, OR GOLD

WHICH WILL GAIN THE MOST AFTER RATE CUTS?

Why are Fed rate cuts relevant to you?

Yield Decline

As rates drop, cash yields above 5% will vanish.

Assets up

Bonds and stocks, which usually rise as interest rates fall, are poised for gains.

Portfolio Tuning

Enhance returns by adjusting your stock-to-bond ratio and lowering cash holdings.

Assets deserve attention

Ride the wave of opportunity

Big Tech

Strong earnings, volatile prices

Earnings Stability: Exhibits robust earnings, though impacted by greater price volatility.

Risk: Be prepared for market-driven fluctuations.

Strategy: Consider regular investments in diversified tech ETFs like QQQ, balancing potential long-term gains against short-term volatility.

Learn more

Small-Cap

Advantageous in low-rate environments

Rate Sensitivity: Typically outperforms larger companies during periods of declining interest rates.

Diverse Sectors: Spreads across finance, healthcare, industrials, tech, and consumer goods.

Low Barrier: Russell 2000 ETF (IWM), VB, DFSV allow easy access to nearly 2000 small-cap companies.

Learn more

US Treasuries

High yields won’t last

Opportunity: High current yields are temporary; ideal for timely investment.

Security: Offers significant security with low risk, suitable for large-volume investments.

Long-Term: The 20- year bond ETF(TLT)has a big potential.*

*Based on the September 4, 2024 price of $97.75, with a historical high of $179.7.

Learn more

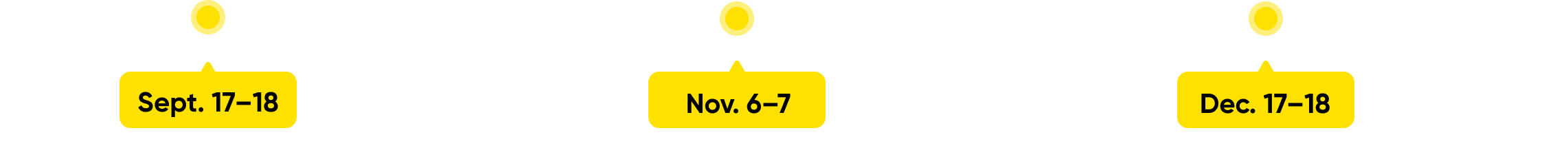

2024 FOMC Meetings

Trading special

*Please go to the Tiger APP - "Rewards Center" to view the instructions and requirements for using rewards.

Not financial advice. All investment involves risk.

Investment opportunities

Big Tech

Small-Cap

US Treasuries

*T&Cs Apply. Capital at Risk. Not Investment Advice. Please visit our website for more details.